Unlocking the Power of Credit Cards for Shopping

- Preetam Chakraborty

- Nov 21, 2025

- 4 min read

Updated: Dec 23, 2025

Earn Rewards on Every Purchase

One of the biggest advantages of using credit cards for shopping is the ability to earn rewards. These rewards come in different forms, making every purchase more valuable.

Cashback

Many credit cards offer cashback on your spending. For example, you might get 1-5% cashback on groceries, fuel, or online shopping. This means if you spend ₹10,000 on groceries, you could get ₹100 to ₹500 back, effectively reducing your expenses.

Reward Points

Instead of cashback, some cards accumulate points for every rupee spent. These points can be redeemed for vouchers, gadgets, or even travel tickets. For instance, a card might offer 1 point per ₹100 spent, and 10,000 points could be exchanged for a ₹500 voucher.

Co-branded Benefits

Certain credit cards are tied to popular brands like Amazon, Flipkart, or Myntra. These cards often provide extra perks such as 5-10% cashback during sales or exclusive early access to deals. If you frequently shop on these platforms, a co-branded card can save you a significant amount.

Exclusive Discounts and Offers

Credit cards often come with special discounts and offers that are not available to other payment methods.

Instant Discounts

During major sales events like Big Billion Days or Amazon Great Indian Festival, many credit cards offer flat discounts on purchases. For example, a card might give you ₹1,000 off on a minimum spend of ₹5,000, making your shopping more affordable.

Partner Deals

Credit card companies partner with various brands to offer special prices on food delivery, fashion, electronics, and travel bookings. For example, you might get 20% off on your favorite food delivery app or exclusive deals on airline tickets booked with your card.

EMI Options for Big Buys

Large purchases can strain your budget, but credit cards provide a solution through easy monthly installments (EMIs).

No-Cost or Low-Cost EMIs

Many cards allow you to convert big purchases into EMIs without extra interest or with minimal charges. For example, buying a ₹50,000 smartphone can be split into 10 monthly payments of ₹5,000, easing your cash flow.

Manage Cash Flow

This option helps you avoid delaying important purchases while keeping your finances manageable. It’s especially useful during festive seasons or when buying expensive electronics and appliances.

Safe and Secure Transactions

Shopping online or offline with credit cards offers security features that protect your money.

Fraud Protection

Credit cards come with fraud protection and zero liability policies for unauthorized transactions. If someone uses your card without permission, you won’t be held responsible for those charges.

Virtual Cards and OTP Authentication

Many banks provide virtual credit cards for online shopping, adding an extra layer of security. One-time passwords (OTP) sent to your phone ensure that only you can authorize transactions.

Build Credit Score While You Shop

Using credit cards responsibly can help you build a strong credit history.

Paying Bills on Time

When you pay your credit card bills on time, it reflects positively on your credit score. A good credit score is essential for future loans, mortgages, or even renting a home.

Credit History Benefits

A strong credit history can lead to better loan terms and lower interest rates. Shopping with a credit card and managing payments well is a simple way to build this history.

Top Credit Cards for Bargain Hunters

Here are five top credit cards in India for 2025 that come with no joining or annual fees, perfect for shopping enthusiasts seeking rewards without additional expenses.

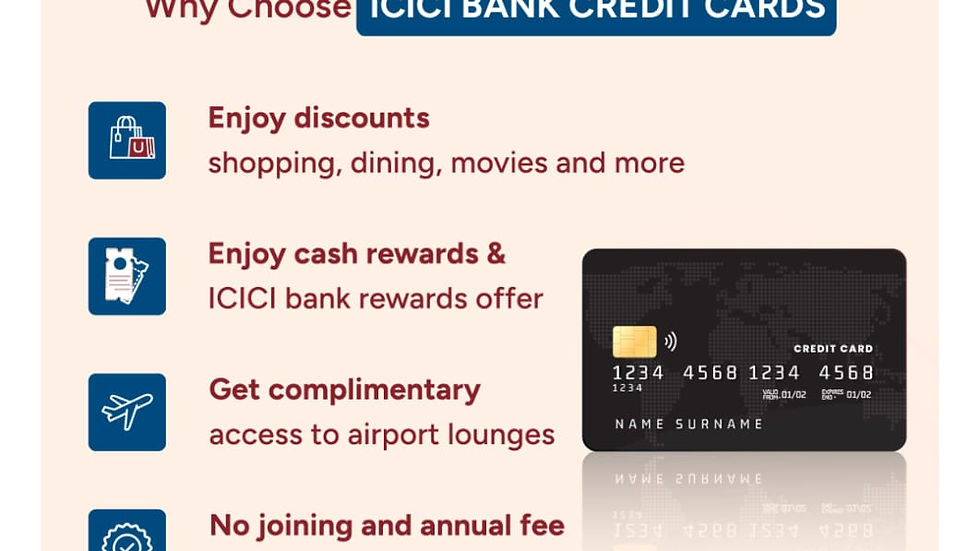

💵 Benefit from cash rewards and ICICI bank rewards offer

✈️ Access airport lounges for free

⛽ Save on fuel with discounts and a waiver of the fuel surcharge

🎉 No joining or annual fee on selected variants

KIWI Yes Bank Rupay Credit Card

💳 Lifetime Free Credit Card – No joining or annual fees

📲 Use Anywhere – Pay via any UPI app with your virtual card

⚡ Instant Activation – Simple onboarding and verification

💰 No Minimum Spend required to use your card

🔁 2x Assured Cashback on every “Scan & Pay” transaction

🏦 Instant Cashback Credit – Redeem anytime, directly to your bank account

Looking for a Lifetime Free Credit Card? 💳

Get the HSBC Platinum RuPay Credit Card:

✅ Zero annual fee forever

💰 Cashback & rewards on spends

📱 Works on UPI for easy payments

💼 Safe, smart & digital banking

Lifetime Free Credit Card

Add on: Rupay/UPI Card just @ ₹199

🥳 Reward Points

- 3X Rewards on Online and Offline spends

- 10X Rewards on monthly spends above ₹20,000

- 1X Rewards on insurance and utility transactions

- No Expiry

🤩 Additional benefits

- 25% Off at movie tickets once a month (via PayTM)

- Free roadside assistance worth ₹1499

- Up to 20% discount across 1500+ restaurants and merchants

🛡 Insurance protection: Personal Accident Cover, Lost Card Liability Covers

Note: You will get the card variant as per your profile once you enter the journey.

2 Reward points/ ₹100 spent on LIC payment

💳 Lifetime free credit card

✈️ 8 domestic lounge visits/ year (Signature)

⛽️ 1% surcharge waiver on fuel spends

Pro Tips for Smart Shopping with Credit Cards

To get the most out of your credit card, keep these tips in mind:

Choose the Right Card

Pick a card that matches your shopping habits. If you shop mostly online, look for cards with online shopping rewards. For groceries or fuel, select cards offering cashback in those categories.

Track Your Spending

Use mobile apps or monthly statements to monitor your expenses. This helps avoid overspending and keeps your budget in check.

Pay in Full Every Month

Clear your credit card balance each month to avoid interest charges. Carrying a balance can quickly increase your debt due to high interest rates.

Watch for Fees

Even cards with no annual fees may charge for late payments or cash withdrawals. Be aware of these to avoid unexpected costs.

Conclusion

Credit cards are powerful tools for savvy shoppers. They provide rewards, discounts, and security. By using them wisely, you can enhance your shopping experience and save money. Embrace the benefits of credit cards and shop smart!

Comments